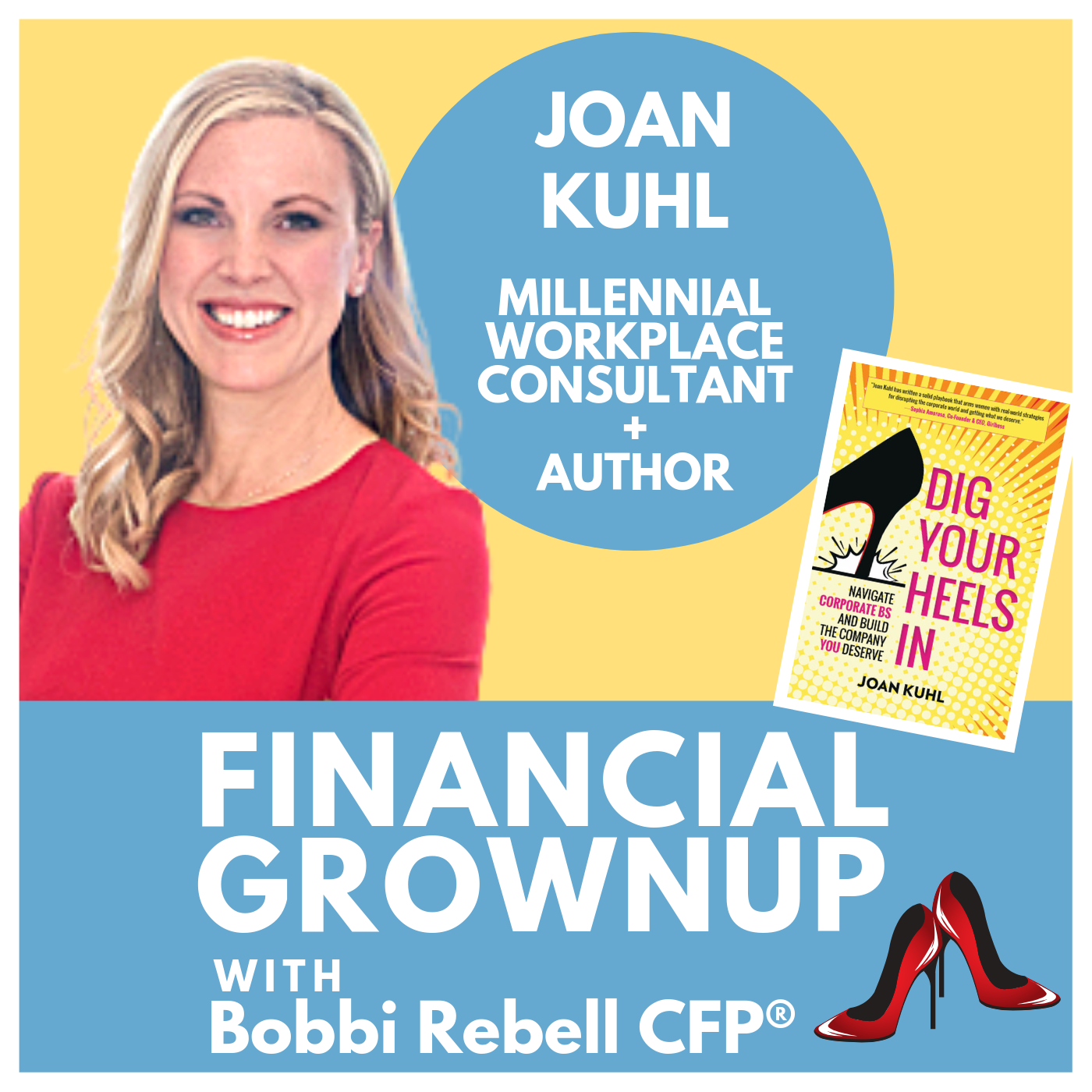

As a child, Joan Kuhl watched her single mom face severe financial discrimination. She shares the story of how this could have prevented the family from buying a home, and how it inspired her to become an advocate and mentor for women in the workplace. Plus money tips and a preview of her new book “Dig Your Heels In”.

In Joan's money story you will learn:

The important role her single mother played in her life

The reason she felt like her mother was great role model

Why her mother was charged more money for mortgage as a single parent

The reason her mother believed it was important to know how to negotiate

“There are so many men that are coming to the table saying I believe my colleagues should be treated fairly and I want to be part of this new world where everyone has equal opportunity to go to a workplace that is fair.“

In Joan’s money lesson you will learn:

Know what you deserve

"We’re never going to really achieve this inclusive culture in the workplace if we don’t dig our heels in and go after the things that we deserve"

In Joan's everyday money tip you will learn:

How Joan's $200 cash rule can really help you to put your spending into perspective

"They were bragging to me telling me what their starting salary was. I used that to then tell people what I thought I deserved.“

In My Take you will learn:

You can’t just say “I quit” and make it happen. There’s a lot of great things that can happen in a corporate job. So tread carefully before you jump. Also read her book.

Keep your ears open and gather intel. Joan was able to negotiate a better deal because her male friends were bragging. Tune in to what others are saying.

Episode Links:

Joan's book Dig Your Heels In can also be bought here on Amazon

Check out Joan's website -

www.JoanKuhl.com

Follow Joan!

Instagram - @JoanKuhl

Twitter - @JoanKuhl

Facebook - @JoanKuhlSpeaker

LinkedIn - @JoanKuhl

Some of the links in this post are affiliate links. This means if you click on the link and purchase the item, I will receive an affiliate commission at no extra cost to you. All opinions remain my own.