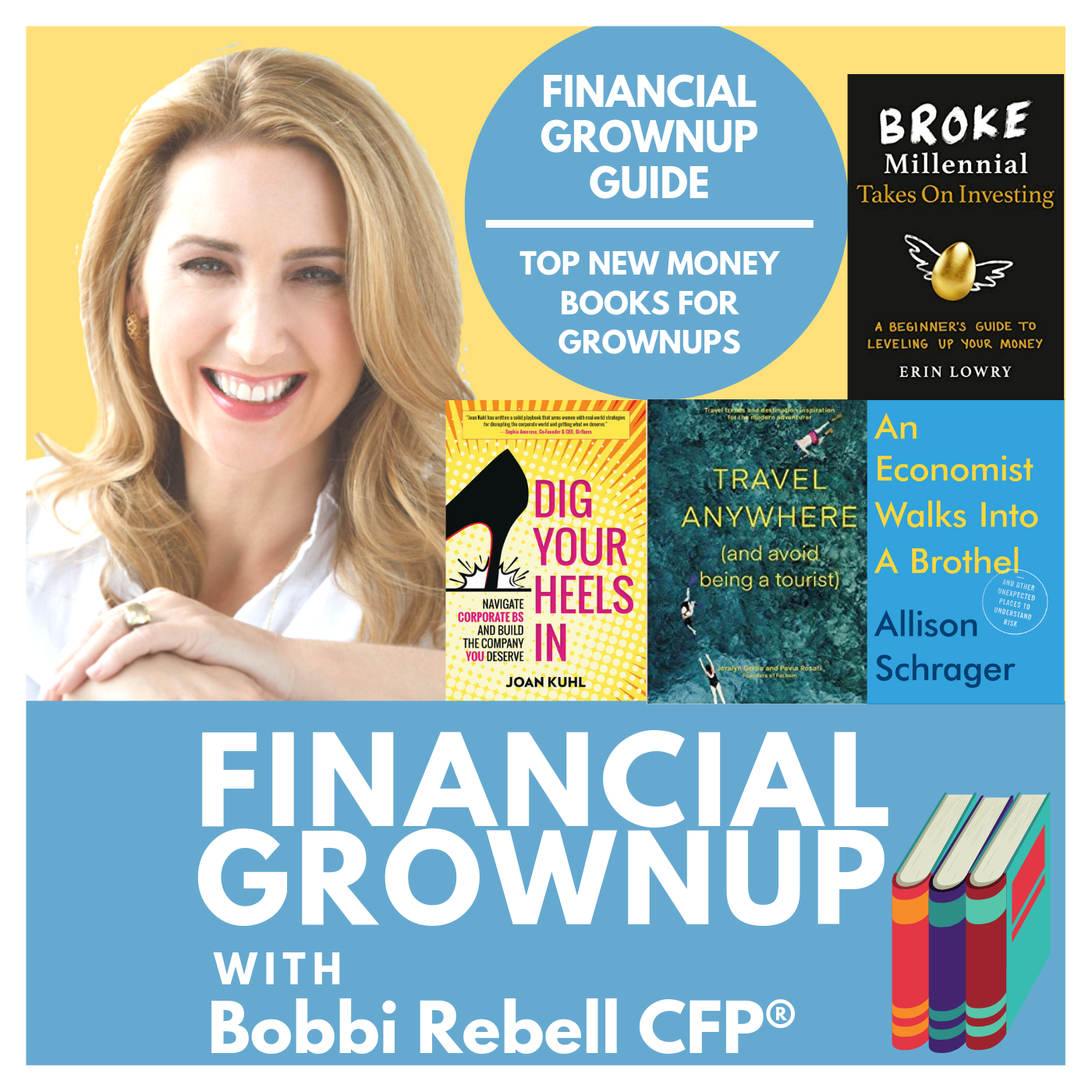

The best new money books for Financial Grownups.

May 2019 Edition.

Once a month we feature a handful of books by authors that have appeared on the financial grownup podcast and share with you some of the reasons I chose to have the authors on the show. My promise is to be candid about how you can decide if the book is the best selection for your time and goals. For example, Dig your Heels in by Joan Kuhl. While it has the most amazing strategies for staying in the corporate workforce, if you are in full startup mode or already feeling pretty solid in your entrepreneurial ventures, it maybe not the best investment of your reading time.

Some ground rules:

There will be only positive comments. Because why waste your time telling you about something I don’t think is worth your time.

Also - we limit our selections to books written by authors that appear on the podcast. In most cases they will have already appeared- so you can then go back and listen to their episode if you want to learn more. Occasionally, the episode will be in the future - so hopefully you will subscribe so you don’t miss it.

Here are 3 books (+ a bonus book) I truly enjoyed in the past month!

Book #1

Let’s start with the one with one that is by Erin Lowry, whose brand “Broke Millennial’ no longer applies to her- and actually for those who follow her- never really did if we are being honest. She’s always been pretty money conscious.

Here are three things I liked about her new book Broke Millennial takes on Investing. A beginner’s guide to leveling up your money.

There is no attitude. Erin takes ownership of the fact that her readers literally may know nothing about investing and will take her explanations down to the most basic level. The things we all pretend to know because we think we should. So for example, when she explains what asset allocation is, she uses the term risk tolerance but then takes the time to explain what that is.

She owns the fact that she is the writer- and not always the expert- so she seeks out experts including Jen Barrett from Acorns, Certified Financial Planner Doug Boneparth and Jill Schlesinger- the latter two have been on this podcast- and yes we’ll have links to them and their books in the shownotes as well.

And finally- Erin gets personal about the financial grownup lessons she learned from her parents- and very specific. For example, her dad declared at age 24 that he wanted to be a millionaire by age 40. Did he? You probably guessed correctly but read the book to confirm.

Who should read this book:

Anyone who hears about investing and is curious but doesn’t know where to start, as well as beginners who want to get a better handle on what they are doing, and a little validation along the way.

Book #2.

Dig Your Heels In. Navigate Corporate BS and Build the Company You Deserve by Joan Kuhl.

This is just what it sounds like- it’s about finding a way to stay in a corporate job when you really want to tell them to go to you know where.

Here’s what I liked about it:

Her strategist are specific and laid out for the reader- but there is also no bs that you have to do the work. For example, she talks about different ways to achieve goals. And is honest that you have to figure out who has the power to get you to that goal. But you have to do the work to seek out those people and find a way to get them to advocate for you. There are solutions here but no easy fix. She’s just being honest.

There are some big revelations that I had no idea about- things like how opportunities and promotions are really decided behind closed doors that you think you know but you don’t. Like pre-gaming for reviews. Read the book. Joan has secrets.

She did a lot of legwork and has interviewed an unbelievable number of high level women and men so there is propriety research in this book. Specific first person stories of how the most successful people make it work and yes, dig their heels in.

Who should read this book?

I’m going to say both genders, but the truth is Kuhl is speaking primarily to women.. in large part because more women quit the corporate workforce in droves to deal with the demands of family- and these days they often start their own thing. But for women who would like to find a way to work things out, this is the best thing ever. As I said when Joan was on the podcast, I wish I had this book when I was at Thomson Reuters as a tv anchor and trying to balance my family life.

Book #3:

An Economist Walks into a Brothel and other Unexpected Places to Understand Risk by economist Allison Schrager who is also with Quartz.

Here’s what I liked about it:

If we are being honest, the title. I mean- I love that Allison Schrager had the guts to just put it out there there is definitely a shock value to this book.

The fascinating different stories illustrating risk and reward in industries from surfing to paparazzi to the movie business.. and of course the brother. You learn economics- but you also learn a lot of behind the scenes dirt about these very cool niche businesses.

The author has a real point of view. She takes a stand. For examples, Schrager gives us permission- and justification to NOT take risks that don’t make sense. “Taking more risk than necessary is inefficient.”

Who is this book for?

People whose eyes glaze over when someone starts talking economics and risk. In a way- It’s for the nerds that haven’t yet come to terms with their nerdiness.. we’re turned off by insider jargon and boring explanations- but secretly really do want to know all the data- just in a really fun and accessible way. This book is story telling at it’s finest.

Bonus Book (because technically it is not a money book):

Travel Anywhere and Avoid Being a Tourist by financial grownup guest Pavia Rosati and her Fathom co-founder Jeralyn Gerba

The authors met as editors at Daily Candy and then later teamed up to launch the travel platform Fathom. It is an editorial website and so much more. You can find digital guides- as well as help planning your travel through their concierge service which I have personally used and loved when I went to Iceland.

Here’s what I liked about the book:

I love it for all the reasons you should not read it on a kindle! This is just a beautiful book to just experience. Stunning photos and a beautiful layout and sharp focused writing.

There are actual money saving tips - like hostels where you feel like you are staying at a boutique hotel, and a nice little travel hacks section with tips like how much to invest in a top of the line suitcase, what to check on your data plan before you go and knowing your auto insurance coverage in advance. Doing these things can potentially save you a ton of money.

The Digital Nomads chapter. Because although in theory we talk a lot about shutting off all the electronics when we travel, sometimes it’s just really nice not to be judged when we choose not to. Put another way- what if you get to travel because your work is portable- not everyone with a laptop on a beach is a slave to their job- it could be quite the opposite.

Who is this book for:

People that already travel a lot and are looking for fresh perspectives, and those who want to travel but just don’t know where to get started.I personally can feel overwhelmed and so fearful of making a mistake that I can’t even get started. And of course it’s great If you just want to look at beautiful pictures and learn about all the world has to offer- even if it’s not on your calendar in the immediate future. This book can just be for the love of relaxing with a special book. I’m not giving away my copy any time soon.

Episode Links:

Blinkist - The app I’m loving right now. Please use our link to support the show and get a free trial.

Erin Lowry’s Financial Grownup episode + Get your copy of Broke Millennial takes on Investing

Joan Kuhl’s Financial Grownup episode + Get your copy of Dig Your Heels In

Allison Schrager’s Financial Grownup episode + Get your copy of An Economist Walks into a Brothel

Pavia Rosati’s Financial Grownup episode + Get your copy of Travel Anywhere and Avoid Being a Tourist

Some of the links in this post are affiliate links. This means if you click on the link and purchase the item, I will receive an affiliate commission at no extra cost to you. All opinions remain my own.