Bobbi reveals her favorite new money related books for financial grownups, and how to decide if they are right for you. This episode's picks include Undaunted, Overcoming doubts and doubters by Hint Founder and CEO Kara Goldin, The Rocket Years, How your Twenties Launch the Rest of Your Life, by Elizabeth Segran, The Money Tree, A story about Finding the Fortune in Your Own Backyard by Chris Guillebeau and The Well-Centered Home: Simple Steps to Increase Mindfulness, Self-Awareness, and Happiness Where You Live by William Hirsch. Plus a bonus fiction pick; They Wish They Were Us by Jessica Goodman

Book 1: Undaunted. Overcoming doubts and doubters by Kara Goldin.

Here’s what I liked about the book:

Kara is the founder of Hint and while I have yet to meet her in person we’ve got a lot of friends in common and have spoken many times- I thought I knew her pretty well before I read her book. And certainly from all the articles that have been written about her success. I had no idea. Kara reveals a lot in this book -and it is interesting because it’s really the candid and not so pretty personal side of a business launch. Things we just assume ‘get done’ she was actually, often with her family in tow, just doing herself. And even when it looks like - oh - she made it-there she is on the cover of a magazine being lauded for her achievements- behind the scenes- the business hit another HUGE challenge- and all that work could just go “poof’. The book also has a lot of “what would I have done given those choices- all of which were bad choices?” - something we can probably all relate to during the pandemic. I was on the edge of my seat reading this- not typical for a business book. Highly recommend.

Who is this book for?

It’s pretty obvious this book is going to be a home run for entrepreneurs who are bootstrapping it- Kara and her family literally put in their own money - and not always by choice- when there was no other funding option.

But it is also for anyone dealing with tough career choices in this pandemic. As much as Kara has done well with this venture- she wonders along the way- would it have been easier- and frankly MORE lucrative- to have stayed on the corporate track. The books also has great lessons about balancing your business and your family- when it is not always realistic to separate them- we can all relate to the blending of work and family - and not by choice- and Kara has great lessons on how to deal with it all.

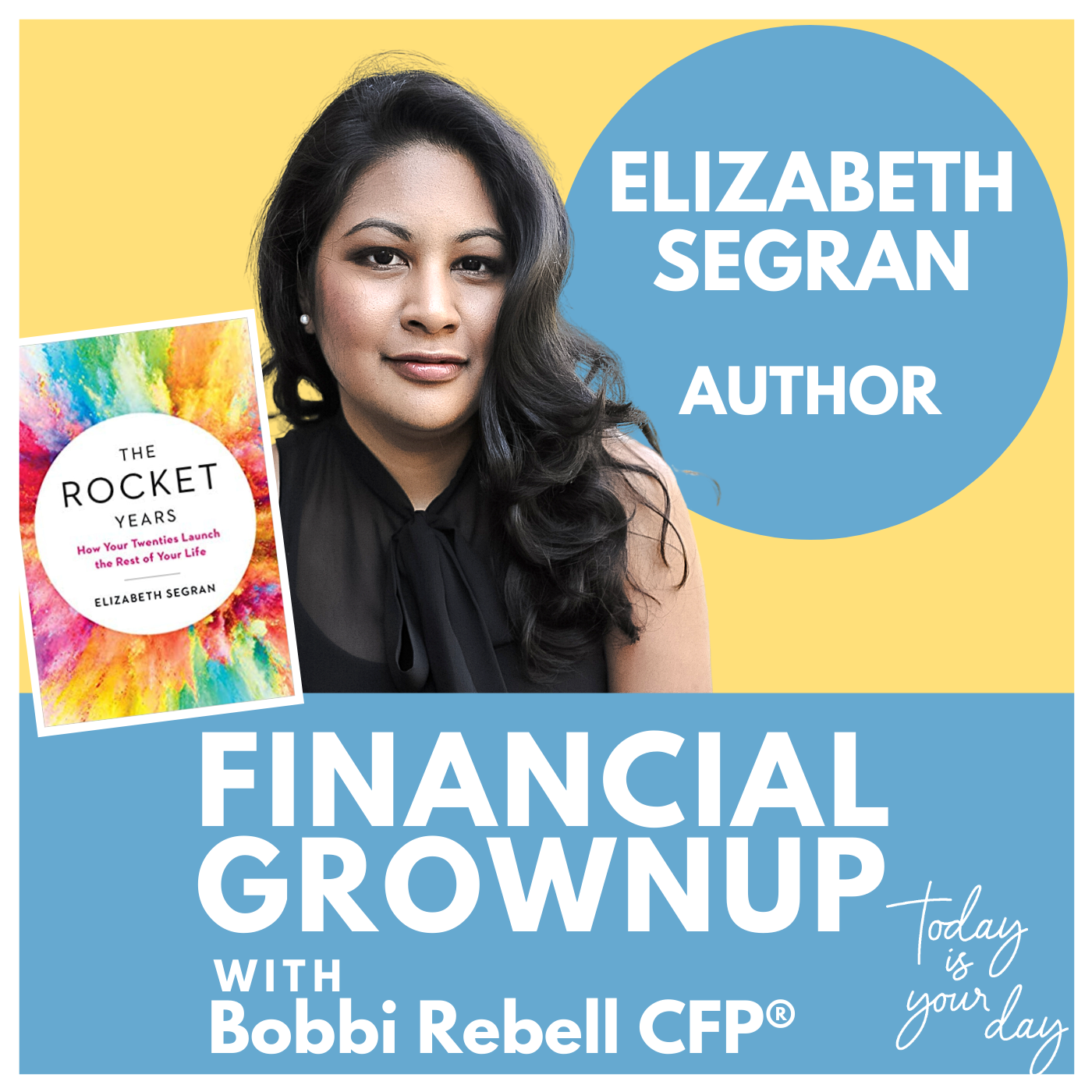

Book #2: The Rocket Years, How your Twenties Launch the Rest of Your Life, by Elizabeth Segran

Here’s what I liked about the book

I loved seeing the choices of a twenty something through her unique vantage point. Liz clarifies the impact of the decisions we make in a way that really has not been presented before - and that’s not easy to do. I also like the way she outlined the different aspects of the Rocket Years - meaning your 20’s. Its not all financial-it’s a whole ecosystem that works together to form who you are and to a larger extent than many of us consciously realize, the life we will lead.

Who is this book for?

The book is written for twenty somethings figuring out their lives- but it is telling that the author wrote it in her thirties.. so it is also something anyone out of their twenties can use to reflect on the choices they have made, and the impact they have had. That’s why I love it.

And you can learn more about Liz and have her answer your questions by listening to my other podcast Money with Friends- where she is a regular co-host this season- it’s in all the places podcasts are- and also we record the episodes live on the money with friends tube channel so please subscribe to the money with friends youtube channel as well.

Book #3: The Money Tree, A story about Finding the Fortune in Your Own Backyard by Chris Guillebeau

Here’s what I liked about the book

This book is super creative in that it uses a fictional storyline to share a unique perspective on the money decisions we all make. At first I thought it would be pretty predictable but it wasn’t. There are unexpected plot twists and an ending I did not see coming. I didn’t know Chris at all when I did his interview for the Financial Grownup podcast but I was so wowed by him that I asked him to be part of Money with Friends. He was so great on that podcast as well.

Chris is a wonderful story teller- which is a true credit to him because his previous six books - including Side Hustle: From Idea to Income in 27 Days were non-fiction.

Who is this book right for:

I love this for anyone trying to figure out who they are- from a money perspective. By that I mean- what are your actual priorities? What are you willing to do to achieve your goals? Are you willing to stop being a victim and start taking action? Are you willing to put in the work? This book will be incredibly motivating. I love it as a book heading not just into a New Year in general - but heading into 2021- a time when many of us are ready- really ready- to re-start whatever we put on hold or get started with new goals that have formed during 2020. And on that note- it is also an awesome gift for your friends that need a little more motivation when it comes to generating income and taking charge of their own financial life. Kind of a perfect book to help someone become a financial grownup.

Book #4: The Well-Centered Home: Simple Steps to Increase Mindfulness, Self-Awareness, and Happiness Where You Live by William Hirsch.

Here’s what I liked about the book

This is the perfect book for the pandemic and for trying to find new ways to have your work and personal lives co-exist in your home as you never imagined. Our homes were not set up for us to work at this level- and frankly for the vast majority they weren’t set up for us to spend pretty much 24-7 there with our family. I know when I set up my business, I set up to have places to work in my home when my kids were all at school and my husband was at work- often traveling days at a time. The pandemic ended all that.

This is not a book I would have picked up had it not been suggested to me by a friend I really trust- and even though it is not technically a money book- Bill even codes the cost of this tips by cost- so you can prioritize based on your budget.

I have literally put so many ideas from the book to work: I now have greenery outside my window- and feel good knowing that Bill said it is perfectly fine if that greenery is fake. It actually makes me feel calmer to look out at my fake green hedge. I also use his pebbles technique- where you get rid of little distractions around your home- yes- change the lightbulb- and make sure it is warm color! Pick up the clutter, fix that squeeky door. You get the idea. He has tips on how to arrange your furniture, how to use specific ways of using art on the walls- even things like putting framed windows in your homes to serve as surrogate windows. I did some eye rolls- until I realized- this stuff really works.

Who is this book right for?

Everyone whose home life has been impacted by the pandemic. Read it and take notes. And of course listen to Bill’s episode of the podcast. You can also read the show notes on my website bobbirebell.com- just search for his name in the search bar at the top of the website.

Bonus Fiction Book: They With They Were Us by Jessica Goodman

This was a total page turner and I’m going to have an interview with the author, Cosmo editor Jessica Goodman early in 2021. I could not put this down. Not a surprise it is being turned into a TV series called The Players Table- which will make total sense after you read the book. It is going to star Sydney Sweeney from the series Euphoria- as well as Halsey. It has been described as quote “Gossip Girl meets One of Us Is Lying with a dash of The Secret History in this slick, taut murder mystery set against the backdrop of an exclusive prep school on Long Island”

Episode Links:

My Bookshop page: https://bookshop.org/lists/financial-grownup-authors

Undaunted, Overcoming doubts and doubters by Hint Founder and CEO Kara Goldin

The Rocket Years, How your Twenties Launch the Rest of Your Life by Elizabeth Segran

The Money Tree, A story about Finding the Fortune in Your Own Backyard by Chris Guillebeau

The Well-Centered Home: Simple Steps to Increase Mindfulness, Self-Awareness, and Happiness Where You Live by William Hirsch

They Wish They Were Us by Jessica Goodman

Some of the links in this post are affiliate links. This means if you click on the link and purchase the item, I will receive an affiliate commission at no extra cost to you. All opinions remain my own.