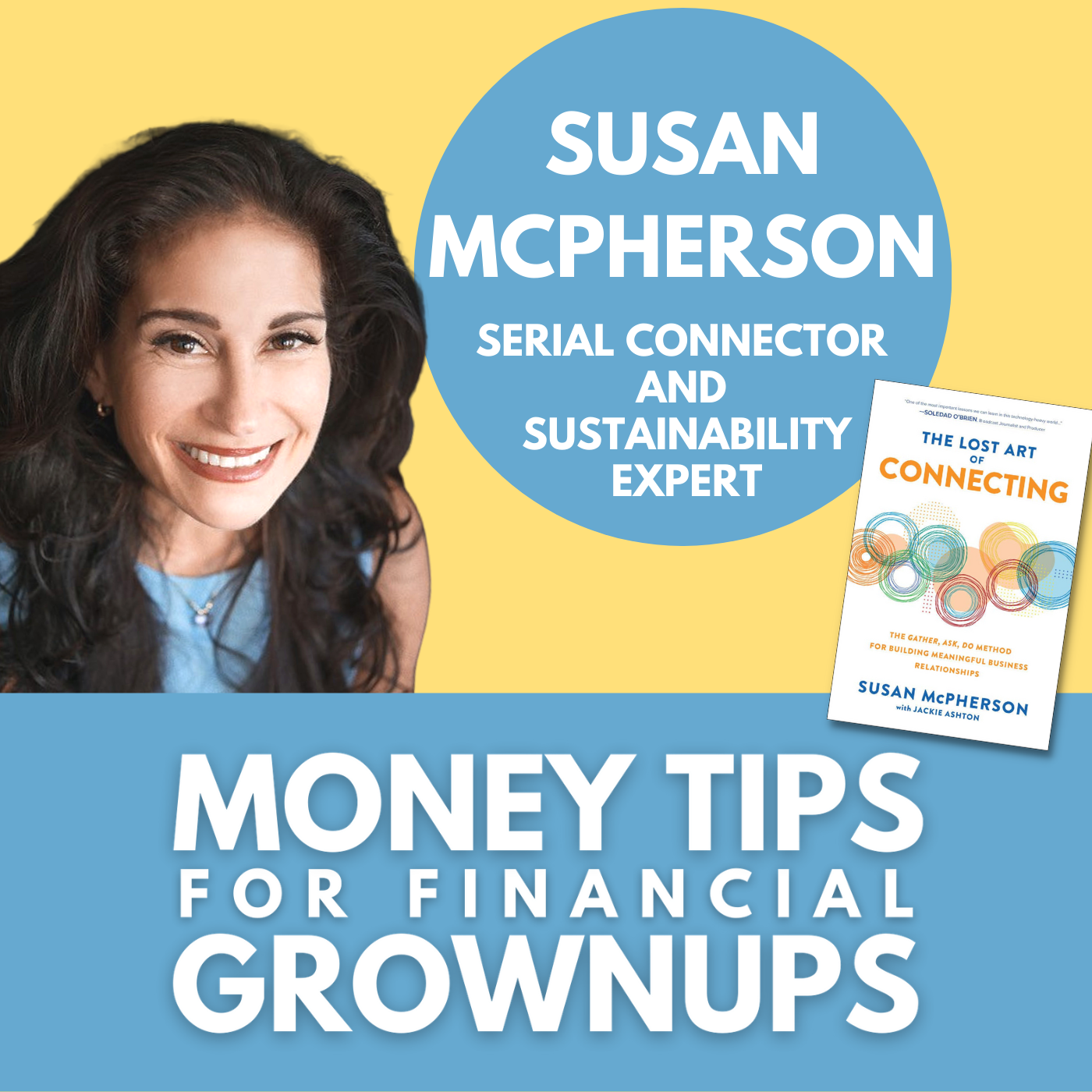

Susan McPherson, author of the new book, The Lost Art of Connecting: The Gather, Ask, Do Method for Building Meaningful Relationships shares 5 specific tips to connect and intentionally leverage your network of friends and colleagues.

Susan’s 5 Easy Tips for Daily Connection

#1 - Spend a little bit of time reflecting and thinking about what it is you want to accomplish when you emerge. Think about the communities and the people you want to surround you because you do have this opportunity now.

#2 - Maybe it's time to forget FOMO, that fear of missing out and instead create JOMO, which is a little bit different than what you may think. Instead of the joy of missing out, it's actually the joy of meeting others. As we return to a sense of normalcy, consider becoming a convener. For those of you who tend to be more introverted, this does not mean you have to gather a hundred people. You can create a convening of four friends or four colleagues and ask them to each bring one and voila! No more FOMO.

#3 - Ask questions. To truly build connection, I would highly recommend learning the art of the ask. Have five or six questions at the ready, that will help you elicit meaningful responses from those you are chatting with. So instead of just talking about yourself, start asking people questions, not about the weather, not about what they had for lunch today, but how they honestly are doing, or how have they fared during the last 12 months and what are they looking forward to, in the next 12 months?

#4- Let's step up our listening skills and believe it or not, something like 75% of the time, most of us are distracted and that's partially due to all the devices and all of just the daily mayhem, that every one of us lives through. But I carry a notebook with me now, and maybe that's just a sign of my aging feeble brain, but more importantly, it helps me remember when somebody tells me something about themselves and therefore I'm able to follow up, in a more expedient and more reliable fashion.

#5- Once you've listened, after asking the important questions, the followup is vitally important because that establishes trust. It establishes reliability and dependability, all the things that you want to be, professionally and probably personally as well. So if you truly listen and go so far as take notes, you will have all the tools you need to actually artfully follow up and be effective.

Bobbi’s Takeaways:

#1 - Create a system to track those connections. Susan talked about carrying a notebook to jot things down about people so she doesn't forget. I'm going to write that down, to come up with a system for myself, because if I had a notebook, I'd probably misplace the notebook, but I'm going to come up with a system, probably something on my phone, because even though I tend to lose my phone, I do always seem to find it.

#2 - Make it personal. So Susan talked about reaching out to a handful of people each day. I've been on the receiving end of this from Susan and it's awesome. She sends these photos from gatherings that she's had with me in it with a quick, "Thinking of you." Takes probably a moment on her time, but it totally makes my day.

Get your copy of The Lost Art of Connecting: The Gather, Ask, Do Method for Building Meaningful Business Relationships today!

Follow Susan!

Instagram - @susanmcp1

Twitter- @susanmcp1

LinkedIn- Susan McPherson

Website- www.mcpstrategies.com

Follow Bobbi!

Instagram - @bobbirebell1

Twitter- @bobbirebell

LinkedIn- Bobbi Rebell

Website- http://www.bobbirebell.com/

Did you enjoy the show? We would love your support!

Leave a review on Apple Podcasts or wherever you listen to podcasts. We love reading what our listeners think of the show!

Subscribe to the podcast, so you never miss an episode.

Share the podcast with your family, friends, and co-workers.

Tag me on Instagram @bobbirebell1 and you’ll automatically be entered to win books by our favorite guests and merch from our Grownup Gear shop.

Full Transcript:

Susan McPherson: This is a way of leading yourself professionally and personally, to be of support because it all will come back. It will all come back around and I can honestly say the dopamine you get, it feels really good to be helping others.

Bobbi Rebell: You're listening to Financial Grownup with me, certified financial planner, Bobbi Rebell, author of How to Be a Financial Grownup, and you know what? Being a grownup is really hard, especially when it comes to money, but it's okay. We're going to get there together. I'm going to bring you one money story from a financial grownup, one lesson, and then my take on how you can make it your own. We got this.

Bobbi Rebell: Hey friends, today's show is going to put a smile on your face. This week's financial grownup is my dear friend, Susan McPherson. She is back to share her pandemic project, and that is her new book, The Lost Art of Connecting: The Gather, Ask, Do Method for Building Meaningful Relationships. Susan is the founder and CEO of McPherson Strategies, a communications consultancy that focuses on the intersection of brands and social impact. When not in quarantine, Susan's a prominent speaker at top conferences around the globe. She's also a contributor to the Harvard Business Review, Fast Company and Forbes, and you've probably seen or heard her or read her work in the media everywhere from NPR to CNN, to USA today, the New Yorker, New York Magazine and The Los Angeles Times and many more. She is also an angel investor, and if we're going to cut to the chase, she is huge on social media. By the way, fun fact, Susan has run six marathons.

Bobbi Rebell: Her book, for us, could not come at a more perfect time. As I read the book, I got so many ideas of things that I can do to specifically enjoy spending time with people and frankly, being a better friend and being a more effective person in my business and professional relationships and just enjoying it all more. And a reminder, you're going to be tempted to take notes but please focus your attention on the gems that Susan shares. We've got a summary for you right on my website, BobbiRebell.com. Just go to the Financial Grownup Podcast dropdown menu and when you click on Susan's episode, you'll see that summary, along with all the links you need and below that, a full transcript. Here is Susan McPherson. Susan McPherson, welcome back. You are a financial grownup. We're so happy to have you here again.

Susan McPherson: Bobbi, I couldn't pick a better place to be.

Bobbi Rebell: We are going to be talking about your new book, The Lost Art of Connecting: The Gather, Ask, Do Method for Building Meaningful Relationships and what better time than now when we are just on the cusp, I hope, oh please, I hope of getting out of this debacle that has been quarantine, COVID-19 and the last year, right?

Susan McPherson: Absolutely. But I have to say, if anything, over this last year, one thing we all have realized is how much we miss human connection.

Bobbi Rebell: So true, and you are the ultimate connector. I mean, literally so funny because at the beginning of this book, you talk about the fact that some people have called you a human CRM app and that's so true.

Susan McPherson: It is something I have loved all my life so what better than to excel at something that you love doing?

Bobbi Rebell: Well as someone that has personally benefited from your generosity and your graciousness and your giving nature, I can just, first of all, attest to the truth of that. You did bring with you five practical tips for daily connection with colleagues, neighbors, and others in your community and network. That's the formal name, but you know what? Really we're talking about how to reset after everything that's been going on. What's your first tip?

Susan McPherson: Spend a little bit of time now, reflecting and thinking about what it is you want to accomplish when you emerge. Do some old fashion navel-gazing and think about the communities and the people you want to surround you because you do have this opportunity now.

Bobbi Rebell: Very well said, what is your second tip?

Susan McPherson : Maybe it's time to forget FOMO, that fear of missing out and instead create JOMO, which is a little bit different than what you may think. Instead of the joy of missing out, it's actually the joy of meeting others. As we return to a sense of normalcy, consider becoming a convener, and I will say for those of you who tend to be more introverted, this does not mean you have to gather a hundred people. You can create a convening of four friends or four colleagues and ask them to each bring one and voila, no more FOMO.

Bobbi Rebell: I love that, and it reminds me, and we're going to digress just for a moment of part of your book, where you talk about creating rituals, something our mutual friend, Erica Keswin talks about in her latest book, but that could be part of getting that done, of JOMO.

Susan McPherson: Absolutely. It doesn't all have to be sitting around, having cocktails. You can gather groups for taking a walk and talk. You can gather groups for a cooking class. Again, we've been doing this in some shape, way or form online, but now you have an opportunity to actually potentially maybe by the summer in small groups, doing it in real life.

Bobbi Rebell: Oh, we all can't wait for that. What is your third tip?

Susan McPherson: Well, and this is a big component of the book and it's ask. Ask questions. To truly build connection, first, I would highly recommend learning the art of the ask. Have five or six questions at the ready, that will help you elicit meaningful responses from those you are chatting with. So instead of just talking about yourself, start asking people questions, not about the weather, not about what they had for lunch today, but how they honestly are doing, or how have they fared during the last 12 months and what are they looking forward to, in the next 12 months?

Bobbi Rebell: And one underlying theme in your book, by the way, is the importance of curiosity.

Susan McPherson: Yes. And to me, it's a drug and a positive drug because it is curiosity that leads you to the path to understand and appreciate people for where they are and see people, and most importantly, that curiosity helps you then to be able to follow up and be supportive.

Bobbi Rebell: Which is another big theme in your book, and that brings us to your fourth tip.

Susan McPherson: Yes, well, it's important of course, to ask, but we won't be successful at asking if we don't know how to listen. So number four is, let's step up our listening skills and believe it or not, something like 75% of the time, most of us are distracted and that's partially due to all the devices and all of just the daily mayhem, that every one of us lives through. But I carry a notebook with me now, and maybe that's just a sign of my aging feeble brain, but more importantly, it helps me remember when somebody tells me something about themselves and therefore I'm able to follow up, in a more expedient and probably more reliable fashion.

Bobbi Rebell: That really is everything, and so let's talk about following up and let's get to your fifth tip.

Susan McPherson: My fifth tip is essentially that. Once you've listened, after asking the important questions, the followup is vitally important because that establishes trust. It establishes reliability and dependability, all the things that you want to be, professionally and probably personally as well. So if you truly listen and go so far as take notes, you will have all the tools you need to actually artfully follow up and be effective. I want to just caveat all of this, Bobbi, this isn't about putting everyone else before you, but this is a way of leading yourself, professionally and personally, to be of support, because it all will come back. It will all come back around and I can honestly say the dopamine you get, and you know this Bobbi, you support so many women and men and probably children. That notion, it feels really good to be helping others.

Bobbi Rebell: That reminds me of some advice that your father gave you growing up that really still resonates with you and really hit home for me.

Susan McPherson: Yes, and that was to always ask first how you can be of help, before stepping up and doing.

Bobbi Rebell: Yeah and what would be an example of how someone could put that into, I mean, what I love about this book also is it's so specific and practical, give us some examples first of that, of how someone would put that into their life. Then I'm going to try to squeeze it in one more question before we wrap.

Susan McPherson: Just a week ago, a dear friend of mine introduced me to a lovely woman who is trying to expand her portfolio. She and I had a 30 minute conversation, literally an hour after a conversation, I was able to introduce her to the executive director of an organization whose board I serve on, and literally the next day, she had an opportunity to actually lead a workshop for that organization. So that all happened within 24 hours. I didn't ask for anything in return. Having the conversation with this wonderful woman named Natalie, after that conversation, I was so impressed that I introduced her, again to the executive director of a board whose organization I serve on and was able to facilitate an opportunity for her. That was a perfect example of how it wasn't a huge lift on my part yet it enormously helped Natalie and it also helped the organization for which the board I serve on.

Bobbi Rebell: Absolutely, and it also goes to the fact that we get so busy in our lives, that we sometimes go through phases where we feel like we have to say no to even have time to breathe, and then you have to balance that, because you also have some good advice, you say, "Always take the meeting." Tell us more about that and why that is so important.

Susan McPherson: Well, I have the proof in the pudding for that, and that is, my company is now eight years old and seven years in, I realized that 98% of our business had been inbound, which is pretty remarkable for a consulting firm. I realized that in my twenties and thirties, all those meetings I took, that were yes, challenging at times because of course I was busy, those people came back 20, 30 years later, and it wasn't like when I was 25, I was saying, "Oh, I'm going to be calling on you in 2020 when I have a company, to see if you'll buy services from me." It was not even a glimmer in my brain. So every single person we meet is a conduit to something else, to someone else, to something new, to learn something about ourselves, and if we don't open those doors and we don't take those meetings, we are missing tremendous opportunities. I fervently believe that, and I live that every day.

Bobbi Rebell: It's so true. So many major things in my life have happened by almost chance meetings, little meetings that you didn't think were going to be meaningful, and then they do end up having a huge impact sometimes right then, as in the case you described earlier and sometimes not for years later, and that's also important. They're true friendships. The final thing I wanted to just touch on is you talk about expressing gratitude and that's something that sometimes gets lost in the hustle and bustle. I've certainly been guilty of not always properly thanking everyone that's done amazing things for me. It's tough. We get so busy and so distracted and are just keeping up with the world, certainly as we get back into, hopefully some sense of normalcy now. Talk to me more about expressing gratitude and specific ways that people can do that.

Susan McPherson : Don't overthink it. Sometimes just a quick phone call, a quick text, a DM, shining a light on socials, showcasing someone else. Those are all very immediate, quick and simple and easy. You don't have to go so far as sending flowers or sending cookies, although that's certainly a wonderful thing to do, but whatever is going to be the most expedient way, sometimes, is the best way, because that's the way it'll get done. But I think it's important to plan one bit of gratitude, every single day, and that includes gratitude for yourself.

Bobbi Rebell: And as you mentioned earlier, it's important to give, but it's also important to be practical and also look out for yourself.

Susan McPherson: Absolutely.

Bobbi Rebell: Susan, this has been so wonderful. Tell us more about where people can find out more about you. We know your book is going to be on sale, literally everywhere. So I hope people will pick it up and continue to get all of these incredible gems. It is very readable. I will tell you that.

Susan McPherson: Aww.

Bobbi Rebell: It's precise, specific, practical in all the best ways, and yet it has the warmth of your personality in it. Where can people follow up with you, once they get the book?

Susan McPherson: First of all, I am glowing. Thank you so much. Hearing that from you means the world to me, Bobbi. I have so much respect for you personally, professionally. Thank you. You can find me at my company's website, McPStrategies.com. I'm on all the social platforms with the name @SusanMcP1 and of course the book can be purchased at your local bookstores or any of the major online booksellers, and I am grateful for you to give it a shot.

Bobbi Rebell: Thank you so much.

Susan McPherson: Thank you.

Bobbi Rebell: All right, guys, that was an awesome interview. Here's my take. Financial grownup tip number one, create a system to track those connections. Susan talked about carrying a notebook to jot things down about people so she doesn't forget. I'm going to write that down, to come up with a system for myself, because if I had a notebook, I'd probably misplace the notebook, but I'm going to come up with a system, probably something on my phone, because even though I tend to lose my phone, I do always seem to find it, but you get the idea and by the way, feel free to send me your suggestions for how I can implement Susan's methodology for this, but we're going to go with the phone for now.

Bobbi Rebell: Financial grownup tip number two, make it personal. So Susan talked about reaching out to a handful of people each day. I've been on the receiving end of this from Susan and it's awesome. She sends these photos from gatherings that she's had with me in it with a quick, "Thinking of you." Takes probably a moment on her time, but it totally makes my day. So I want to ask you guys, what little things make big impacts on your days? DM me on Instagram, @BobbiRebell1, I would love more ideas. And while you're at it, help me give away some incredible books.

Stay in touch on Instagram @BobbiRebell1 and on Twitter @BobbiRebell. You can email us at hello@financialgrownup.com, and if you enjoy the show, please tell a friend and maybe leave a review on Apple podcasts. It only takes a couple minutes. Join us next time for more stories to help you live your best grown-up life.